Case study – project – purchase > renovate > rent/sell

Context

This case study details a real estate project aimed at purchasing, renovating, and renting out an apartment in Brussels, specifically near Thieffry metro station in Etterbeek.

The project was carried out in 2019—prior to the implementation of regulations penalizing properties with poor PEB (energy performance) scores in categories E, F, and G.

The unit analyzed in this study is the first-floor apartment of a building comprising four separate flats. At the time of acquisition, this unit had a PEB rating of D.

Preliminaries

To act swiftly in a competitive real estate market, a

significant amount of groundwork is essential. While this article does not

delve into every aspect of that preparation, the key elements that were

clarified prior to this investment include:

(1) Financing

- A clear budget was set for both the purchase and the renovation.

- No bank financing was used. (If financing is needed, one must clearly understand their borrowing capacity and associated costs.)

(2) Renovation Scope

- Acceptable works ranged from light touch-ups to full interior renovation.

- The following types of renovations were excluded:

- Any work requiring a permit or oversight by an architect.

- Projects needing permission to subdivide a building into multiple units (if not already legally done).

- Any structural renovations requiring coordinated work throughout the building.

(3) Timings

- Purchasing a currently rented property was acceptable, anticipating a potential 6+ month delay before beginning renovations.

- Renovation team availability and capability were established. The selected team could manage demolition, electrical work, tiling, and kitchen/bathroom installations.

- Supervision of the works was also pre-arranged and manageable within the team’s capacity.

(4) Project Goals

- Long-term rental was the primary goal. (Short-term rentals such as Airbnb were excluded; if considered, legal and practical feasibility must be assessed.)

- Depending on market conditions, resale after five years was an option—to avoid capital gains tax in Belgium.

(5) Market Knowledge

- Solid understanding of market pricing for similar properties in the area.

- Expected rental yields post-renovation were realistically estimated.

Opportunity

The property was owned by a single individual and consisted of four rental apartments under long-term (9-year) contracts. The first-floor apartment had been rented out under the same contract for over nine years by the time of purchase.

Due to years of non-indexed rent increases, the existing rental income (€732/month) did not reflect market value—particularly after a planned full renovation.

Importantly, the building was originally constructed as four separate residential units, a fact documented in the deed, removing any concerns over unauthorized subdivisions.

The seller preferred to sell all units in a single transaction without involving agencies. The four buyers—who knew each other—agreed to proceed jointly with a single notary, simplifying the process.

Purchase price for the full building: €720,000

Cost of the first-floor apartment: €180,000

Notary fees: ~10% of the purchase price

No loans or mortgages were used.

Renovation

The purchase was finalized in October 2019, while the tenant still occupied the apartment. Fortunately, she gave advance notice of her departure, allowing renovations to begin in March 2020.

Scope of Renovation

- Flooring: Replaced outdated tiles in the entry hall, living room, and kitchen.

- Bathroom: Completely redone. The small, unusable bathtub was replaced by a modern Italian-style shower.

- Toilet: Fully renovated to match the bathroom style.

- Kitchen: Old fittings were replaced with a new, fully equipped IKEA kitchen.

- Walls: Bold-colored wallpapers were removed and replaced with neutral white paint throughout.

- Additional Improvements:

- Installation of a new, individual heating system.

- Full compliance of the electrical installation.

Total renovation cost: Under €30,000 (≈15% of the purchase price)

Due to delays in material delivery caused by COVID-19 lockdowns, the apartment was only listed in June 2020. It was rented by July 2020 for €900/month.

Achievement

The apartment was rented immediately after renovation and has remained continuously occupied with no vacancy periods or need for additional works, as of the time of writing.

The monthly rent increased from €732 to €900, representing a +23% increase, directly attributable to the renovation efforts and improved energy efficiency, functionality, and aesthetic appeal of the apartment. This demonstrates the clear financial impact of well-targeted renovations on rental income.

As a benchmark, the third-floor apartment, which underwent a slightly more comprehensive renovation, was sold in 2024—more than five years after the initial purchase—for €330,000, further validating the investment strategy.

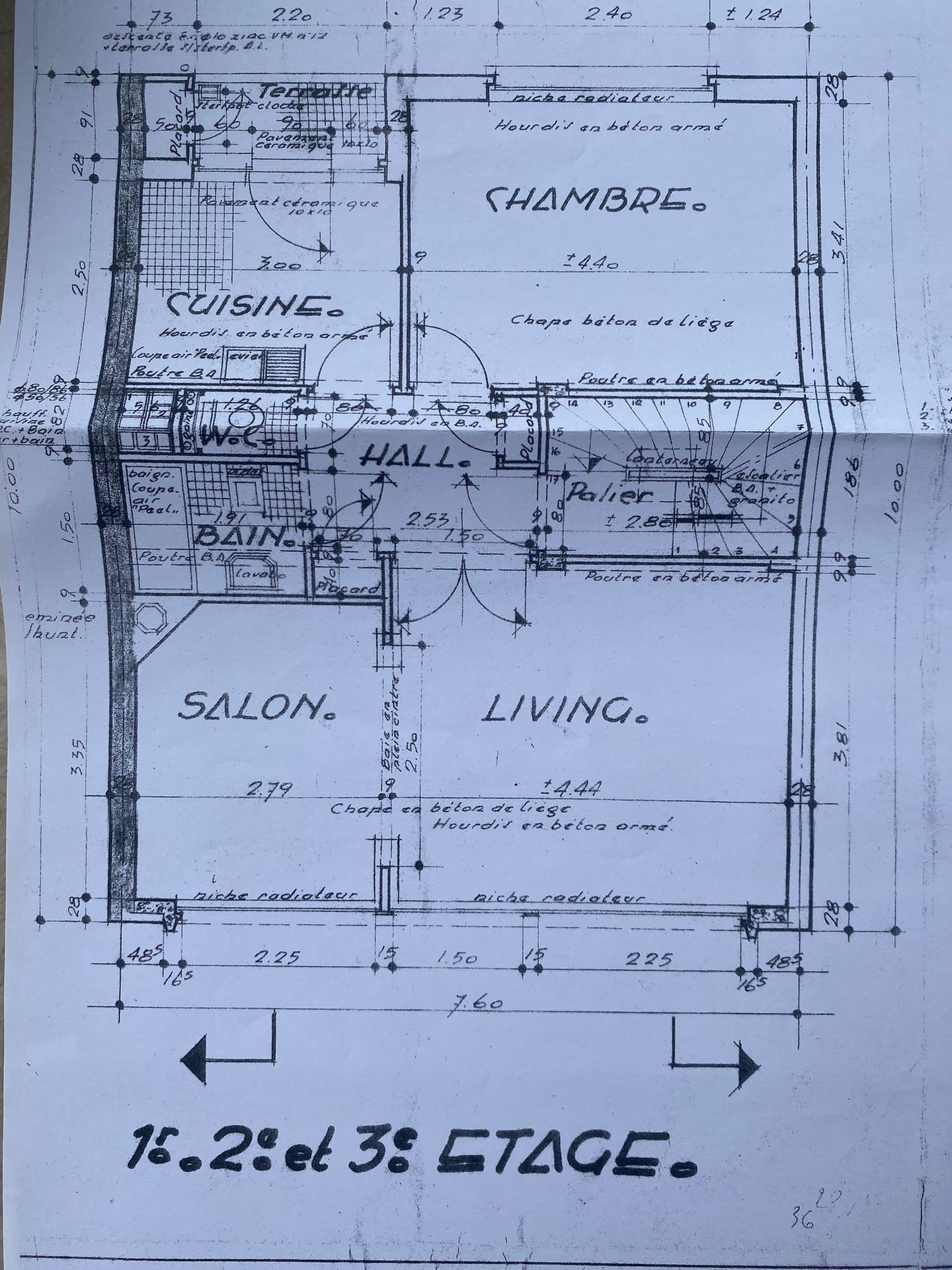

Architect plan

Kitchen - results + ongoing works

Living room - final result & ongoing works